Condo Insurance in and around Glenwood

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

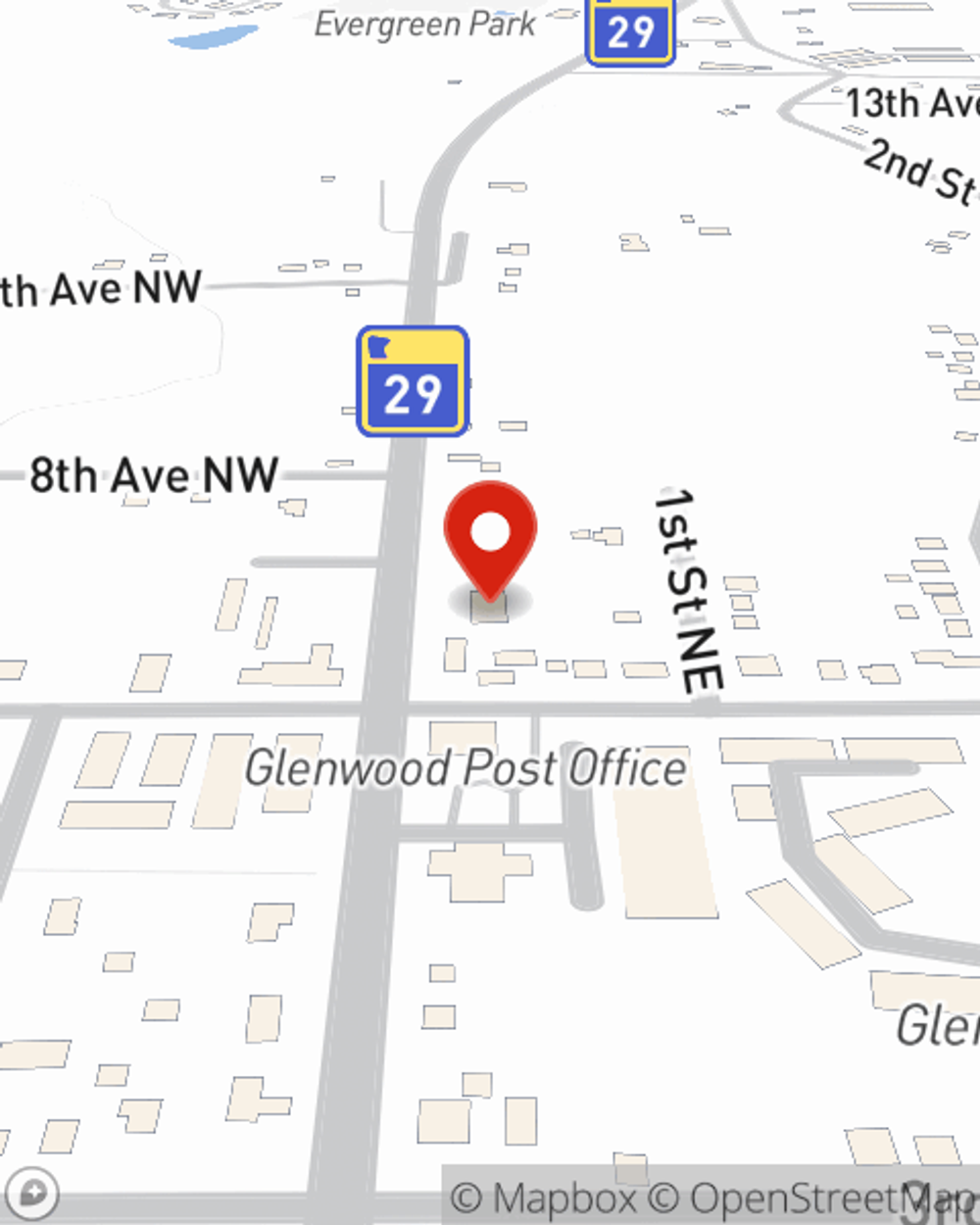

- Glenwood

- Starbuck

- Alexandria

- Villard

- Brooten

- Lowry

- Osakis

- Benson

- Belgrade

- Forada

- Garfield

- Millerville

- Carlos

- Miltona

- Sauk Centre

- Cyrus

Home Is Where Your Heart Is

When you think of "home", your condo is first to come to mind. That's your refuge, where you have made and are still making memories with family and friends. It doesn't matter what you're doing - laughing, catching your breath, playing - your condo is your space.

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Agent Amy Roers, At Your Service

There's truly no place like home. You need condo unitowners coverage to keep it safe! You’ll get that with Condominium Unitowners Insurance from State Farm, a trusted provider of condo unitowners insurance. Amy Roers is your knowledgeable State Farm Agent who can present coverage options to see which one fits your individual needs. Amy Roers can walk you through the whole coverage process, step by step. You can have a straightforward experience to get coverage options for everything that's meaningful to you. We’re talking about more than just protection for your electronics, swing sets and furnishings. You'll want to protect your family keepsakes—like pictures and souvenirs. And don't forget about all you've collected for your hobbies and interests—like musical instruments and sports equipment. Agent Amy Roers can also let you know about State Farm’s great savings and coverage options. There are savings if you have an automatic sprinkler system or have a claim-free history, and there are plenty of different coverage options, such as additional business property and even personal articles policy.

Don’t let worries about your condo make you unsettled! Visit State Farm Agent Amy Roers today and discover how you can meet your needs with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Amy at (320) 634-3731 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.